A reserve price in an auction is the minimum price that the seller is willing to accept for the item being auctioned. It is the price below which the seller is not obligated to sell the item. The purpose of setting a reserve price is to ensure that the item doesn't sell for less than a certain amount, which the seller considers acceptable.

Also, Read What is EMD (Earnest Money Deposit): Click Here

Also Read, What is Reverse Auction & How it Works

In an auction, the seller sets a reserve price, which is the minimum amount they are willing to accept for the item.

- Bidders then participate by placing bids to try and win the item.

- If the highest bid does not meet or exceed the reserve price, the item is not sold. The seller is not required to sell below their reserve price.

- If the highest bid meets or exceeds the reserve price, the item is sold to the highest bidder.

- The reserve price is usually kept confidential during the auction. This creates some uncertainty for bidders but ensures that the seller does not have to sell for less than their specified price.

If the reserve price is not met, the item remains unsold, and the seller may choose to relist the item in a future auction, either with a new reserve price or for a fixed price.

Reserve prices are often used in different types of auctions, including online auctions, real estate auctions, and traditional in-person auctions, to protect the seller's interests and ensure they receive a minimum acceptable price.

Difference Between Reserve Price and Opening Bid:

Reserve Price:

- The reserve price is the minimum price a seller is willing to accept for the item.

- It is set by the seller when the item is listed for auction.

- Bids must meet or exceed the reserve price for the item to be sold.

- If the highest bid is lower than the reserve price, the seller is not obliged to sell.

- The reserve price is generally not disclosed during the auction.

Opening Bid:

- The opening bid is the starting price for the auction, set by either the auctioneer or the seller.

- It’s the price that initiates the bidding process.

- Bidders place their bids at or above the opening bid.

- The opening bid is always disclosed at the beginning of the auction.

Example of a Reserve Price in Auction:

Consider an example of a reserve price in an online auction for an antique wristwatch:

- The seller, Ramesh, believes the watch is worth at least ₹4,00,000 and sets this as the reserve price.

- The opening bid for the auction is set at ₹1,00,000.

- Bidders start placing bids, but after several rounds, the highest bid is ₹3,80,000, which is below the reserve price.

- Since the reserve price of ₹4,00,000 has not been met, Ramesh is not obligated to sell the watch.

- The auction ends without a sale, and Ramesh can relist the watch at a later time or change the reserve price.

This example shows how the reserve price helps protect the seller, ensuring that they do not sell below what they consider acceptable.

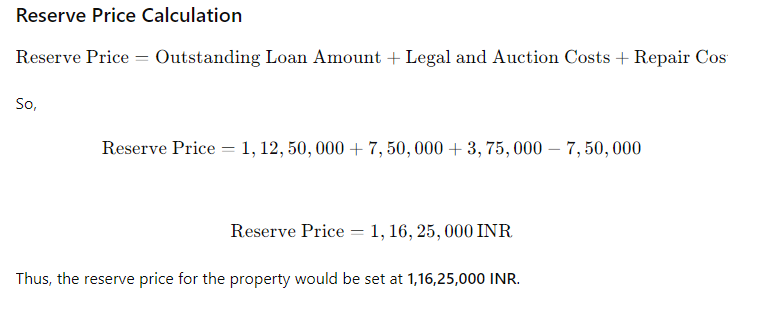

Example Calculation in INR

- Professional Valuation: Property valued at 1,50,00,000 INR.

- Outstanding Loan Amount: 1,12,50,000 INR.

- Legal and Auction Costs: 7,50,000 INR.

- Repair Costs: 3,75,000 INR.

- Depreciation Adjustment: -7,50,000 INR due to the property's age.

Steps to Follow for Calculating Reserve Price in INR

- Obtain a Professional Valuation: Get the market value of the property in INR.

- Calculate the Outstanding Loan Amount: Determine the total outstanding amount including principal and interest in INR.

- Include Legal and Auction Costs: Add any related costs in INR.

- Estimate Repair Costs: Include estimated repair or renovation costs in INR.

- Adjust for Depreciation: Subtract any depreciation value if applicable in INR.

Summing these amounts gives you the reserve price in INR. Adjust as necessary based on market conditions, legal requirements, and strategic considerations.