BLOG DETAILS

The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act was passed by the Indian Parliament in 2002. The Act empowers banks and financial institutions to recover outstanding dues from borrowers by selling their assets without the intervention of a court. The SARFAESI Act is applicable to secured loans above Rs. 1 lakh.

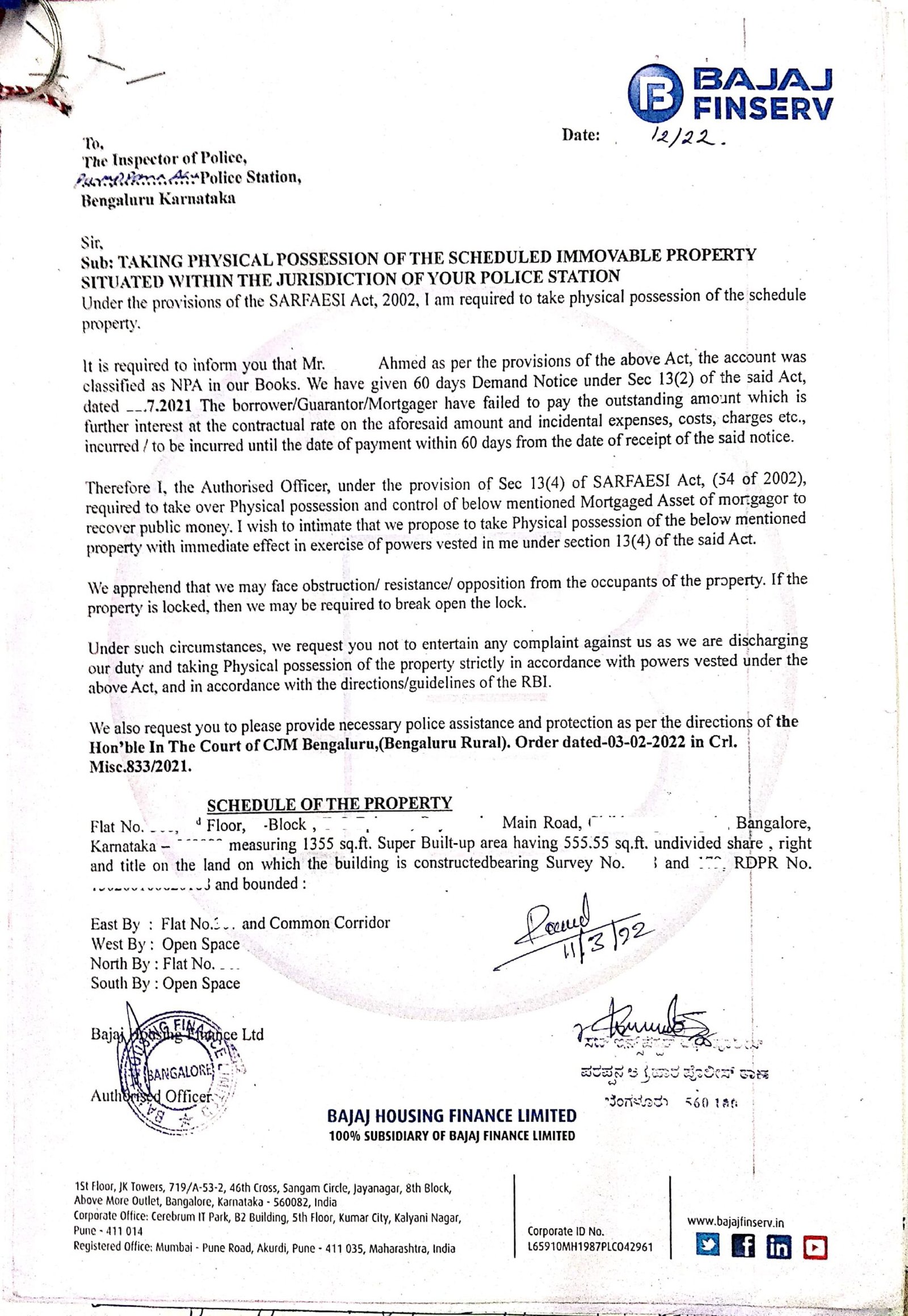

Under the SARFAESI Act, banks are granted the legal authority to issue notices to borrowers, requiring them to settle their outstanding debts within 60 days if they have failed to make loan payments for a continuous six-month period, including home loans.

If the borrower is unable to meet this obligation, the financial institution has the right to sell the property through a distress sale. In the event that a borrower in default believes that the bank's decision is unjust, they have the option to appeal to the relevant authority within 30 days from the date of the order.

Once the bank takes possession of the property, it can either sell or lease it, or delegate the authority to another entity for utilization. The proceeds from the sale are first used to settle the bank's overdue debts. Any surplus funds, if available, are returned to the defaulting borrower after the settlement of the outstanding debt.

The sale of assets under the SARFAESI Act is conducted by the banks or financial institutions that have taken possession of the assets. Once the sale of assets is completed, the bank or financial institution issues a Sale Certificate to the buyer of the assets. The Sale Certificate is an important document that proves the transfer of ownership of the assets from the borrower to the buyer.

The Sale Certificate under the SARFAESI Act should contain the following details:

The procedure for obtaining a Sale Certificate under SARFAESI Act is as follows:

The Sale Certificate is an important document that proves the transfer of ownership of the assets from the borrower to the buyer. It is important for the buyer to obtain the Sale Certificate to establish their ownership over the assets. The Sale Certificate is also required for the buyer to register the asset in their name with the relevant authorities.

The SARFAESI Act, 2002 was created to allow secured creditors to take possession and sell securities without court involvement. The Act defines an "authorized officer" as a senior officer designated by the secured creditor. Rule 9(6) specifies that upon sale confirmation, the authorized officer must issue a sale certificate to the buyer.

Regarding the Registration Act, 1908, Section 17(1) makes registration mandatory for certain documents, while Section 17(2) lists exemptions. Section 17(2)(xii) exempts certificates of sale from public auctions conducted by Civil or Revenue Officers from registration. Section 89 of this Act requires certain documents to be sent to the registering officer and filed, including certificates of sale.

The SARFAESI Act doesn't explicitly equate the authorized officer with a Civil or Revenue Officer. However, a broader interpretation suggests that the authorized officer should be treated similarly under Sections 17(2)(xii) and 89(4) of the Registration Act, given the Act's objectives.

In summary, while the SARFAESI Act doesn't directly include the authorized officer, its purpose implies that they should be considered akin to Civil or Revenue Officers for registration purposes.

This is to certify that in pursuance of the powers conferred upon me under Section [Insert Section number] of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002 ("SARFAESI Act"), I, [Insert name and designation of Authorised Officer], the Authorised Officer of [Insert name of Bank/Financial Institution], having its registered office at [Insert Address], have sold the property described below to [Insert name of purchaser], for a sum of [Insert sale price], on [Insert date of sale], which is considered to be fair and reasonable, after due advertisement in newspapers [Insert name of newspaper] and [Insert name of newspaper], on [Insert dates of advertisement], and after following the due process as per the SARFAESI Act.

The central question is whether the sale certificate issued by an authorised officer (under the SARFAESI Act, 2002) requires mandatory registration under the Registration Act, 1908. Courts across India have delivered conflicting judgments on whether the authorised officer qualifies as a "Civil or Revenue Officer," which would exempt the sale certificate from compulsory registration under Section 17(2)(xii) of the Registration Act.

Several High Courts have held that registration of a sale certificate issued by an authorised officer is mandatory:

Other High Courts, particularly post-Esjaypee Impex (P) Ltd. v. Canara Bank, have taken a contrasting view:

The Supreme Court has played a key role in shaping the current legal position:

Ambiguity in Definition: The crux of the issue lies in the interpretation of the terms "Civil or Revenue Officer" under Section 17(2)(xii) of the Registration Act. While some courts strictly interpret this to exclude authorised officers under SARFAESI, others adopt a broader, more purposive approach, equating them with Revenue Officers based on their public duty and the nature of their work.

Judicial Legislation: Courts such as the Andhra Pradesh High Court in Munirathnam Reddy Kamasani v. District Registrar argue that including authorised officers in the definition of a "Civil or Revenue Officer" would amount to judicial legislation, which is impermissible.

SARFAESI Act’s Objective: The SARFAESI Act was designed to expedite the recovery of debts through secured assets, without unnecessary delays caused by judicial intervention. Courts supportive of exempting sale certificates from registration argue that compulsory registration would counteract this legislative intent, by introducing procedural delays.

Supreme Court’s Final Word: The Supreme Court’s decision in Esjaypee Impex has largely settled the legal debate. The filing of sale certificates under Section 89(4) is sufficient, and such certificates are not subject to compulsory registration under the Registration Act. This ruling effectively overrules earlier decisions like R. Thiagarajan and suggests that courts should interpret the law in a manner consistent with the SARFAESI Act’s purpose.

The said property was mortgaged/charged by [Insert name of borrower] and [Insert name of guarantor(s)], with [Insert name of Bank/Financial Institution], as per the mortgage/charge deed dated [Insert date of mortgage/charge deed], and registered at [Insert the name of registration office and registration number], in favour of the Bank/Financial Institution.

After the borrower [Insert name of borrower] failed to repay the loan amount and defaulted on the payments, the Bank/Financial Institution issued a notice under Section [Insert section number] of the SARFAESI Act, demanding payment of the outstanding amount within [Insert number of days] days, which was not complied with. The Bank/Financial Institution, therefore, took possession of the said property on [Insert date of taking possession] and issued a possession notice to the borrower.

After taking possession of the said property, the Bank/Financial Institution issued a sale notice, inviting bids from the interested parties, which was published in [Insert name of newspaper] and [Insert name of newspaper], on [Insert dates of advertisement]. [Insert name of purchaser], being the highest bidder, was declared as the successful bidder, and the sale was conducted on [Insert date of sale].

I hereby certify that the sale was conducted in a fair and transparent manner, after due advertisement, and that the sale price received was fair and reasonable, and that the sale has been confirmed by the Debts Recovery Tribunal.

This certificate is issued under my hand on this [Insert date of issue].

Authorised Officer, [Insert name of Bank/Financial Institution].

The Sale Certificate under the SARFAESI Act is an important document that establishes the ownership of assets sold under the Act. The Sale Certificate should be obtained by the buyer of the asset to prove their ownership and to register the asset in their name. The format of the Sale Certificate is prescribed by the Act, and the procedure for obtaining the Sale Certificate is straightforward.