BLOG DETAILS

GST on used cars: Now consumers will have to shell out more GST on used cars. He also mentioned that if a business is claiming input tax credit then GST has to be paid on sale value and not margin. If buying used, smaller cars are partially exempted with GST of 12% like Renault Kwid.

The GST Council has proposed a tax rate hike of 18% on the sale of used electric vehicles (EVs) and designated petrol and diesel vehicles.

Only GST at the rate of 18 percent is mandatory to be paid on the margin of businesses that deal in the purchase and sale of used vehicles.

For instance, if a used car platform buys a small car for ₹1 lakh and sells it after repairs for ₹1.4 lakh, then the GST rate of 18 per cent will be levied on the margin alone, i.e. ₹40,000 earned. Earlier, a 12 per cent GST was levied on the margin.

The decision is expected to drive up the price of used vehicles. While some platforms are likely to absorb the higher taxes, others are planning to pass on at least a part of it to retail buyers.

The jump in GST on used cars from 12 per cent to 18 per cent is expected to affect not only car dealers, but also platforms that deal in used cars.

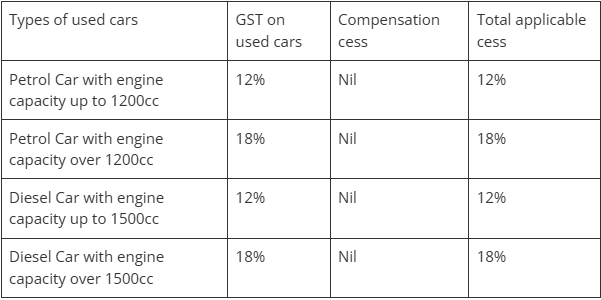

18% GST slab: All electric vehicles (EVs), petrol cars with 1,200 cc (or more) engine capacity or of 4000 mm (or more) length, diesel cars with 1,500 cc or more engine capacity or of 4000 mm (or more) length, and SUVs.

Essentially, the previously stated cars with lower engine capacity and lower length will hence be taxed only under 12 percent GST, which is the prevailing rate.

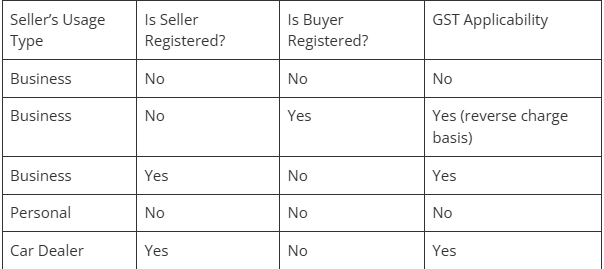

If the transaction is between individual sellers where the seller is not registered for GST then tax will not apply. And then this is true for all the cars.

The Economic Times reported that the GST Council has also not introduced any new liabilities under reverse charge.

This announcement is right in the middle of the massive growth India’s used car market is currently experiencing. As per the Indian Blue Book 2023 report by Das Welt Auto and Car&Bike, the used car market in the country was worth USD 31.33 billion in 2022-23, which may go up to USD 70.48 billion in 2027-28.

The report notes that the average growth rate of the market was only 6% during FY2017 – FY2022 but is expected to rise to 16% during FY2023 – FY2028. By comparison, overall new car sales are forecast to increase at a much more modest pace of just 1% to 6% during the same period.

The sector has seen rapid growth due to factors including an expanding middle class, rising disposable incomes and growing demand for personal mobility.

This is likely to have a huge impact on business such as sale of old/used vehicles and vehicle dealers claiming depreciation on the purchased vehicles. Private individuals buying and selling at auction will not be dissuaded by the tax, however businesses will have to incorporate the elevated rate into their business model.